Eastern PA Conference members will see a restructuring—and perhaps a clarifying—of fiscal policies and assets in the proposed new 2024 conference budget at the annual session May 18-20. But they can get a preview and participate in a Q&A session at the Pre-Annual Conference sessions offered May 9 and 10.

With the aim of managing and investing funds responsibly for “the preservation of capital” and “maximizing funds available for mission,” conference leaders are proposing changes to better align the EPA budget to “advance its strategic direction, mission, goals and strategies…of growing vital mission congregations.” That goal includes allocating designated and restricted funds* according to their various, defined purposes and using a consolidated budget to account for all funds held in the conference’s central treasury.

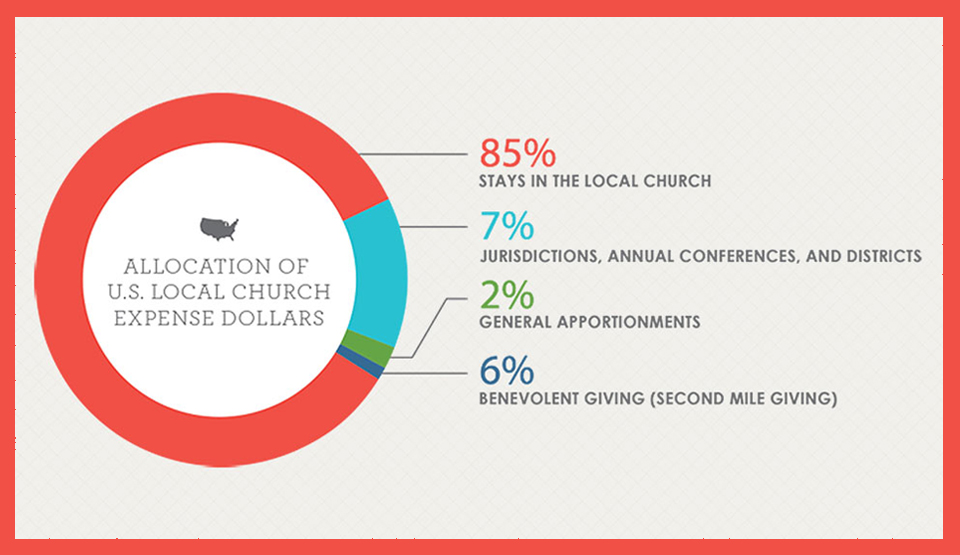

Congregations’ billings will reflect a consolidated budget that clearly identifies line items for program ministry and mission, clergy support, administration, property, and both conference and general church apportionments. They would be responsible for a 7.2% EPA shared (connectional) ministry apportionment and a 2.6% general church apportionment. Historically, total local church giving to general church funds has averaged 82-85%.

But congregations in low-income communities, which are primarily racial-ethnic, would pay reduced amounts under the Journey of Hope equity legislation (formerly the Path Toward Wholeness Plan) approved in 2022. That anti-racism plan also calls for EPA to pay up to 100% of its apportionment to the Black College and Africa University general church funds, if it has a year-end budget surplus.

Healthcare billings over the next four years will move to a single blended rate to provide adequate billing and payment for the cost of clergy and lay employee health care, except for Journey of Hope equity congregations who will receive a lower billing rate because they are in low-income communities. In fact, those congregations will receive discounts for all billed funds, not just healthcare.

Proposed budget responds to challenges

The proposed budget is not without its challenges: EPA must pay a $580,000 share of a $30,000,000 United Methodist settlement with survivors of sexual abuse in the BSA (Boy Scouts of America). To avoid taking the funds directly from Trustee reserves, the proposed budget assesses one-third of the $580,000 as part of its Shared (aka Connectional) Ministry Fund apportionment to churches over the next three years. Thus, the normal assessment formula of 7% has been increased by 2% to accommodate this cost. On the other hand, General Church apportionments have decreased from 2.9% to 2.6% since last year.

But the Treasurer’s Office will also assess modest administrative support fees for shared services provided to restricted and designated funds and trusts. Those shared services include administrative, legal and operational support. Additionally, an 8% uncollectable fee is added to billed funds to account for our historical 92% collection rate in those funds.

Committees to invest, monitor designated, restricted funds

Moreover, EPA’s Board of Trustees and Council on Finance & Administration (CFA) will form an investment committee to “ensure funds are invested in accordance with the social principles of the UMC and prudently to maximize gains so that balances keep pace with present AND future ministry needs. Further, the funds are overseen so that funds are only used for the designated or restricted purpose.”

CFA will also establish an EPA Fund Committee to monitor careful management of designated and restricted funds. And six agencies—CFA, Board of Trustees, Board of Benefits, Camp and Retreat Ministries Board, Connectional Table and Cabinet, along with any EPA mission partners who have funds invested—will meet jointly with institutions managing their funds to analyze investment performance and projections, including the socially responsible impact of those funds.

The CFA investment committee will make investment decisions for each fund, to be executed by EPA’s Chief Financial Officer (CFO). Each designated fund’s purpose will be clearly identified and adhered to and can only be changed by vote of the Annual Conference. Funds will be assigned monitors to ensure that governing policies are followed and that the desired purpose and impact is being achieved. That includes funds from the sale of urban property that are designated to support urban congregations and ministry, according to The Book of Discipline.

The new policies also provide strict rules for disbursements, emergency uses and borrowing from designated funds.

Budget describes 26 designated, restricted funds

The detailed budget proposal lists and describes 26 designated and restricted funds, including their end-of-2022 balances, fund goals and identified monitors. The list categorizes them as Congregational Development, Strategic Disciple Making, Leadership Development, Mission, Benefits, and Property and Operations.

During a detailed budget presentation to Connectional Table members April 18, given by CFO/Treasurer Jo Fielding and CFA Chair Irene Dickinson, Bishop John Schol emphasized the determined efforts of staff to search for often elusive financial records for some older funds. Thus, CFA and conference Trustees will review and act on any valid documents presented that may alter any funds or their amounts.

“The new consolidated budget allows our members to see our ministry in its totality,” said Fielding. “We are not just a $3.4 million organization; we are a $20 million organization with a larger capacity for ministry than we might realize. Our goal is to be transparent in all our finances.

“By putting policies and procedures into place for shared ministry funds, billings, and the use and investment of designated funds,” she explained, “we can ensure that the ministry of this conference has a long future. It also means we are investing in and running our conference in a way that is consistent with our mission, goals and strategies to end the sin of racism, to encourage growth and vitality in our churches—especially those in urban areas—and to raise up transformational leaders.”

*Two types of Funds:

Donor Restricted funds are contributions from an individual or group with a restricted purpose that can only be changed by the individual(s) or their estate. EPA must use restricted funds for the purpose designated by the donor. Only the donor may restrict funds, not EPA. All restricted funds will be managed and dispersed according to the donor’s restriction.

EPA Designated funds are designated by the annual conference and are overseen by a designated body. The annual conference session may vote to change the designated purpose as needed.